Are Bitcoin Investors Back In Accumulation Mode? On-Chain Data Says ‘Possibly’

After the market-wide downturn on October 10, the Bitcoin price showed no definite direction for the rest of the historically bullish month. At the moment, the premier cryptocurrency is struggling to gather any significant momentum to the upside. However, recent on-chain evaluation suggests that this period of relative silence could represent a springboard for the cryptocurrency’s sustained upswing. Sender/Receiver Ratio Falls To One-Year Low In a recent Quicktake post on the CryptoQuant platform, pseudonymous analyst CryptoOnchain shared an interesting insight into Bitcoin’s....

Related News

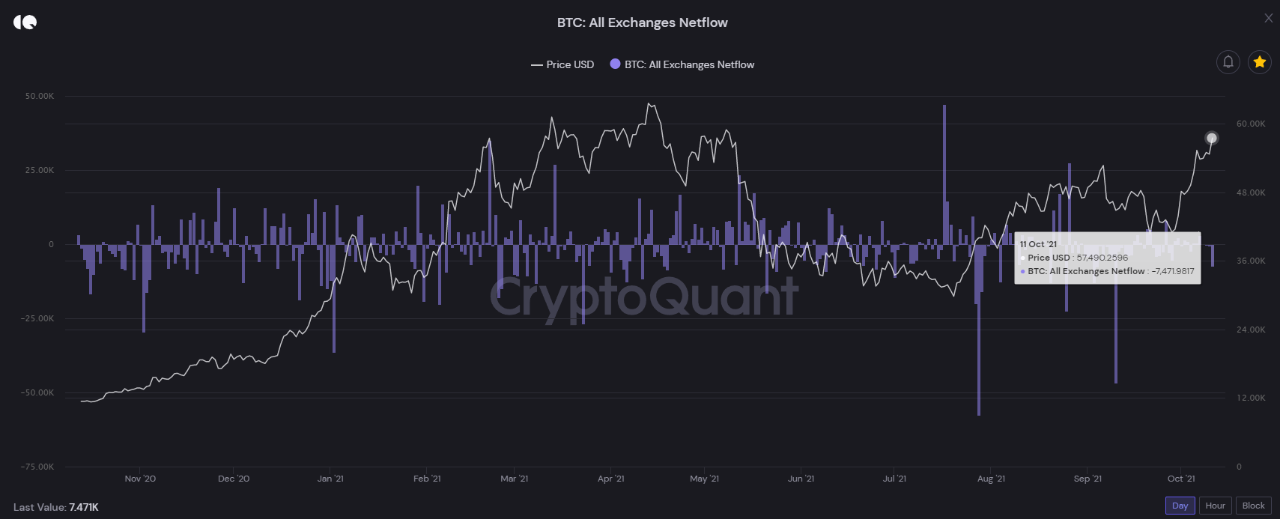

Bitcoin on-chain data suggests accumulation is going on as investors feel FOMO about the current rally above $57k. Bitcoin Accumulation Goes On As Investors Feel FOMO As explained by a CryptoQuant post, on-chain data is showing signs of accumulation as BTC netflows show negative spikes, and the stablecoins inflows indicate big moves. The Bitcoin netflow […]

On-chain data shows the Bitcoin investors with no history of selling are back to intense accumulation, a sign that could be bullish for BTC’s price. Bitcoin Accumulation Addresses Have Been Showing High Demand Recently In a new post on X, the on-chain analytics firm CryptoQuant has talked about how the demand is looking from the […]

On-chain data shows the largest of the Bitcoin whales have returned to distribution, a sign that could be bearish for the asset’s price. Bitcoin Investors With More Than 10,000 BTC Are Selling Again As explained by analyst James V. Straten in a new post on X, the BTC whales, who had earlier been in a phase of accumulation, have switched their behavior to that of distribution now. The relevant indicator here is the “Trend Accumulation Score” from Glassnode, which keeps track of whether Bitcoin investors have been buying or selling during the past month. This metric finds....

As Thursday drew to a close, the entire cryptocurrency market flipped sharply bearish again, causing Dogecoin’s price to fall below the $0.15 mark. Despite the persistent struggle to produce another major rally, traders’ sentiment seems to be turning bullish, leaning towards accumulation, as indicated by a key on-chain metric. Dogecoin Moving Into Accumulation Mode A […]

Shiba Inu bulls are back, with on-chain data indicating heavy accumulation among the meme coin’s investors. Specifically, a 512 billion SHIB transfer has drawn the attention of the crypto community, sparking bullish sentiments towards the meme coin, which has underperformed so far. Shiba Inu Bulls Spark SHIB Accumulation Theory With 512 Billion SHIB Transfer Etherscan […]