PwC Director: Blockchain Impact Could Create Winners and Losers

Global professional services giant PricewaterhouseCoopers (PwC) became the latest big-name firm to make its blockchain service offerings public this month, unveiling a solution portfolio designed to take business clients from ideation to iteration as they explore the emerging technology. The PwC Blockchain Solution Portfolio, a suite of 12 services aimed at spanning the cycle of analysis ongoing at major financial firms, features elements focused on education, evaluation and, ultimately, fostering collaboration between PwC clients and industry partners. Further, the scope of the offering....

Related News

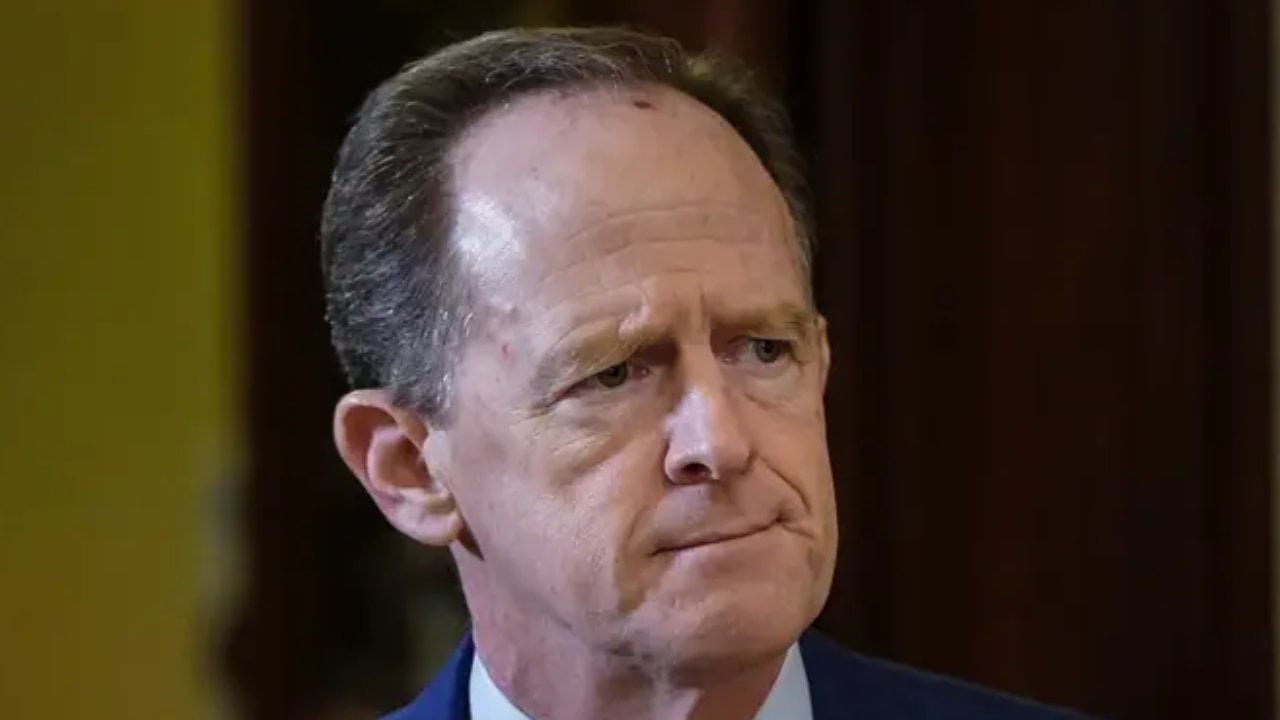

U.S. Senator Pat Toomey has called on Congress to stop the Treasury Department from maximizing its ability to regulate and tax crypto by picking winners and losers. “Congress should not allow that to happen,” he said. US Senator Urges Lawmakers Not to Crush Crypto Innovation Following the endorsement of a crypto tax amendment by the White House, concerns have been raised that the U.S. government is picking winners and losers in the crypto space. Two crypto tax amendments to the $1 trillion infrastructure bill have been introduced but the White House has chosen to endorse the....

Whenever a disruptive concept comes along, there are winners and losers. But things aren't so black-and-white with blockchain technology in the picture. A lot of people have been saying how the blockchain is much bigger than Bitcoin itself, and they are right for the most part. Even though the Bitcoin protocol is powered by blockchain technology, the capabilities of distributed ledgers are not just linked to the digital currency ecosystem. A recent report by Citi seems to be thinking along those same lines, although most of their use cases are still focused on the financial aspect. This....

Ripple Labs has officially responded to the complaint by the U.S. Securities and Exchange Commission (SEC). Besides explaining that the XRP cryptocurrency is not a security, Ripple accuses the securities regulator of being out of step, picking winners and losers, as well as distorting facts regarding the cryptocurrency. In the court document filed on Jan. 29, Ripple claims that XRP is not an “investment contract,” insisting that the crypto “is a virtual currency and thus, outside the SEC’s jurisdiction.” Furthermore, the company stated that it never held an....

Declining demand for Tether and negative futures premiums for altcoins reflect a growing disinterest from crypto investors. On May 12, the total crypto market capitalization reached its lowest close in 10 months and the metric continues to test the $1.23 trillion support level. However, the following seven days were reasonably calm while Bitcoin (BTC) gained 3.4% and Ether (ETH) added a modest 1.5%. Presently, the aggregate crypto cap stands at $1.31 trillion.Total crypto market cap, USD billion. Source: TradingViewRipples from Terra's (LUNA) collapse continue to impact crypto markets,....

The crypto market performed well over the last week, but two key data points hint at a brief cooling off period. The total crypto market capitalization reached its highest close in three months on April 3 at $2.23 trillion, but the performance between March 28 and April 4 was a mere 1.9% gain. During this time, Bitcoin (BTC) presented a 2.6% negative performance, although that was more than offset by the gains from altcoins.Total crypto market cap, USD billion. Source: TradingViewWhile Ether (ETH) and Binance Coin (BNB) gained less than 3% over the past seven days, a handful of....