Bitcoin Price Pulls Back, But Hope for $800 and Beyond Still Strong

It’s happened again, folks. After a stellar increase over the last few days, the bitcoin price has fallen back down to reach a trading mark of around $741 at press time. We’re only a few dollars behind, but the digital currency is following in its “own footsteps.” Bitcoin Price Losing Steam? Not According to Analysts. One source describes bitcoin’s ongoing fluctuations: “It seems prices is teasing us a little at the moment. Just as we get up to the region around which we can start targeting the 800 flat mark as an initial upside target and – beyond that – use it as resistance, the bitcoin....

Related News

Bitcoin price has fallen below long-term support during a cynical trading session today. Hopes of this downturn being a second wave prior to a rally are still alive but ailing fast as price approaches $270 (BitFinex) and 1660 CNY (BTC-China). Bitcoin Trading Pulls Price Down... Again. Time of analysis: 16h00 UTC. Bitstamp, although back online, does not have a functional ticker in its Tradingview chart, so the BTC-China chart will be analysed. BTC-China 1-Hour Chart. Price has, once again, dropped below the long-term support that held so much promise for halting the decline. A proverbial....

Litecoin has been bearish this week after failing to push above 1.72. The 1H chart shows ltcusd declining within a falling channel. Litecoin (LTCUSD) 1H Chart April 9th. Also, we can see that price is now trading under the cluster of 200-, 100-, and 50-hour simple moving averages (SMAs). This represents bearish bias. However, the moving averages have been moving sideways, which means there is no prevailing downtrend in the 1H chart and this week's downswing could still be part of a sideways market. If price pulls back but holds under the 1.67-1.68 area, then we would have more evidence....

The Asian trading session has pulled price up from last night's lows near $470. There are still few clues as to where price is heading, but at least one more low is expected as the analysis below explains. Descending Channel. As identified in yesterday's analysis a descending channel has contained price action for 11 days running. Price has respected the lower channel trendline since first hitting it during trade on Sunday 31 August. This trendline is currently overlapping with the 0.618 Fibonacci retracement level of the entire advance from April to June, and that implies strong support....

The Bitcoin price set a fresh all-time high near $125,700 before easing back as traders locked in gains and reassessed near-term risks. Despite the dip, market structure remains bullish. Spot ETF demand is accelerating, exchange balances are at multi-year lows, and macro tailwinds continue to favor “digital gold.” Related Reading: Ripple Announces Major Privacy Upgrade […]

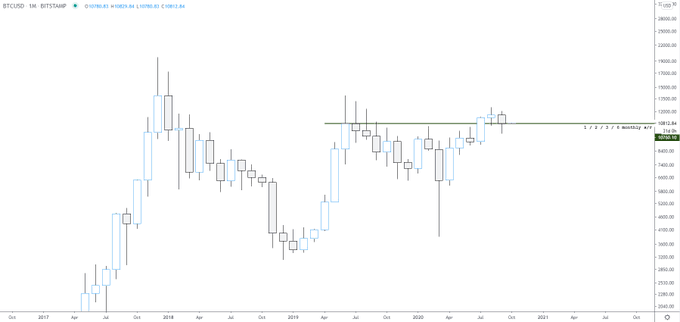

It’s been quite the boring past four weeks for the Bitcoin market. The cryptocurrency, after suffering a strong plunge at the start of the month, was largely rangebound between $10,000 and $11,000 over September. Despite the lack of strong price action, not all hope is lost for Bitcoin bulls. In fact, many analysts remarked at […]