Crypto Under Pressure: Emerging Data Suggests Potential Bear Market Ahead

Following the crypto market crash on October 10, a bearish sentiment has dominated, with on-chain data indicating a continued decline in digital asset prices. Bitcoin (BTC), for instance, is nearing one of its worst weekly performances of the year, having recorded a 6% drop over the past seven days. The leading cryptocurrency has fallen below the critical $100,000 mark for four consecutive days. If this downward trend persists and is confirmed in the coming days, it could exacerbate selling pressure and further instill fear in the market, potentially leading to broader price declines.....

Related News

Bitcoin (BTC) continues to face massive selling pressure, with prices dropping below the $85,000 mark, marking a 12% decline since last Friday. The recent downturn has fueled panic selling and heightened fear, leading many investors to speculate about the potential start of a bear market. As uncertainty grips the market, traders remain cautious about Bitcoin’s next major move. Related Reading: Cardano Bulls Eye $10 Target – Analyst Reveals Key Levels To Break However, despite the ongoing sell-off, key on-chain data from CryptoQuant suggests that Bitcoin could be setting up for a recovery....

Rejoice! The bear market might be over. That’s the main thesis behind July’s “The Bitcoin Monthly” report. “Because bitcoin’s price did not rise parabolically during the 2021 bull market, its bear market correction could be over,” ARK reasons. And it makes sense, the numbers seem to suggest it, and it feels like it. However, are we fooling ourselves? Is ARK’s reasoning wishful thinking? Let’s examine the data and see what it tells us. First of all, “bitcoin closed the month of July up 16.6%, rising from $19,965 to $23,325, its most significant gain since October 2021.” So far, so good. Can....

Ethereum is once again under pressure, struggling to find the strength to reclaim the $4,000 level amid growing uncertainty across the crypto market. Investor sentiment has turned increasingly cautious, with mixed opinions emerging among analysts — some warning that a bear market may be taking shape, while others believe this correction could precede a massive […]

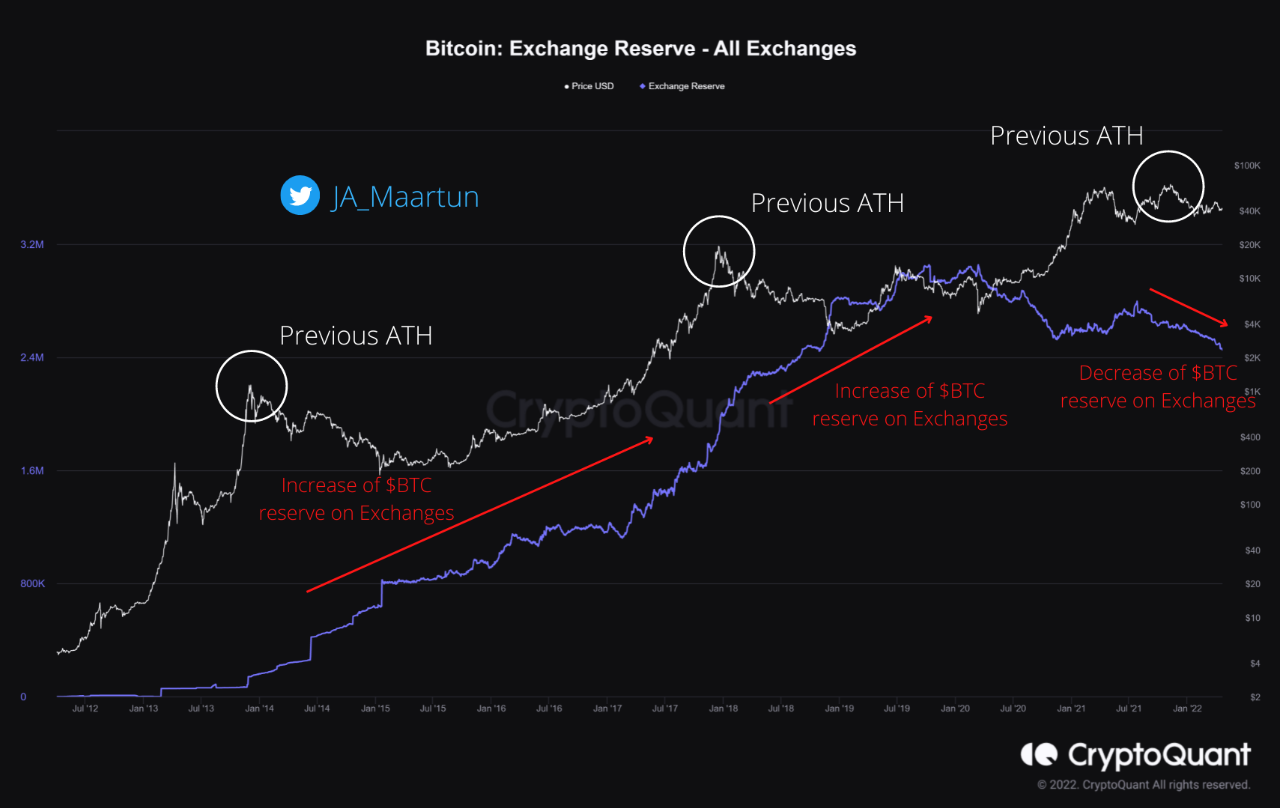

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

Bitcoin is now down over 29% from its all-time high (ATH) in January, and speculation about a coming bear market is growing among investors. After weeks of heavy selling pressure, Bitcoin has entered a consolidation phase, trading between $80K and $85K, with no clear breakout direction yet. Related Reading: BTC Options Market Shows Bullish Bias – […]