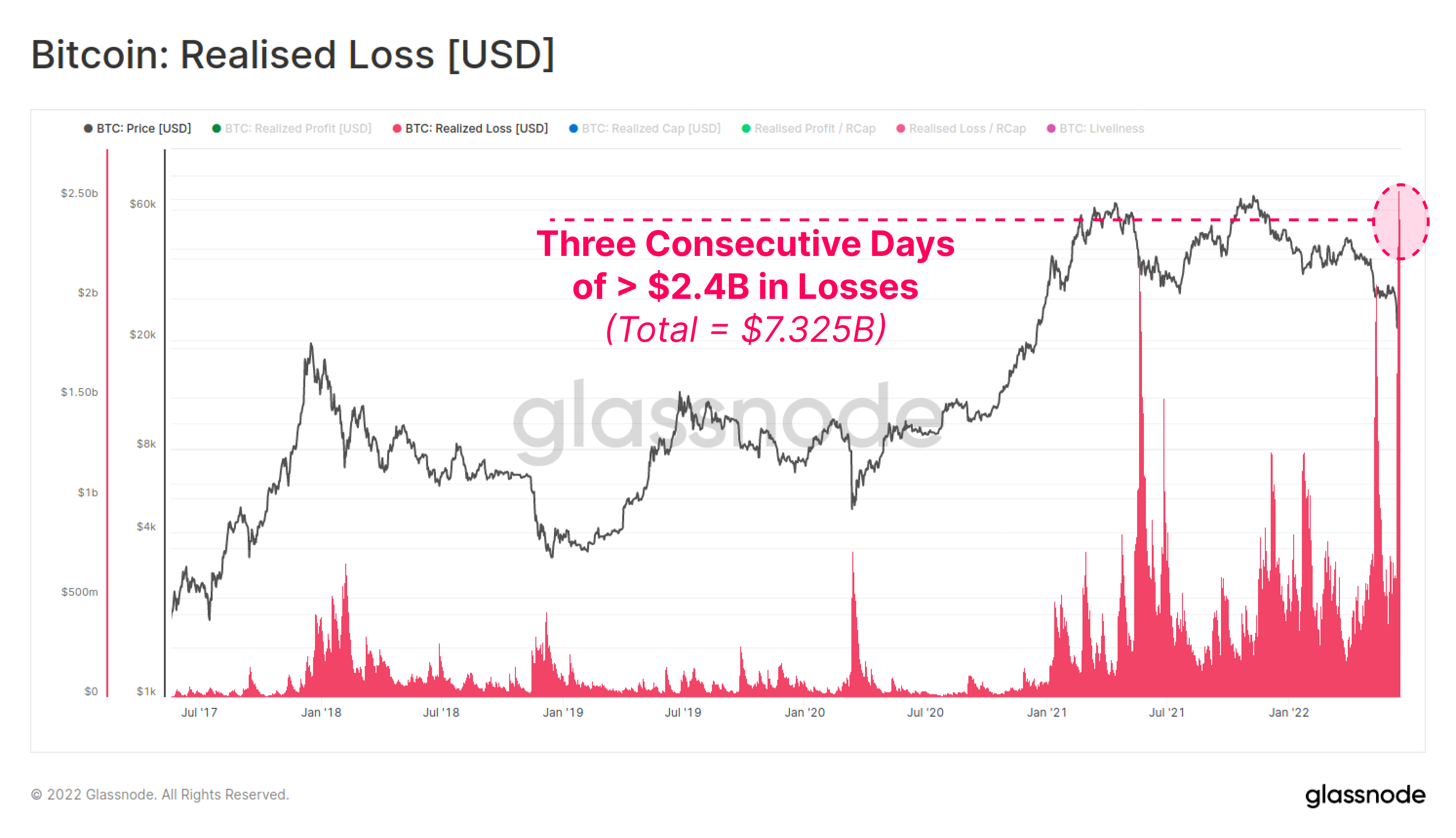

Historic Levels of Realized Losses

Sometimes, the bitcoin market is a wild ride.The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.Over the last 55 days, there has been a historic amount of losses on the Bitcoin network. Over $16 billion worth of losses have been realized since May 13. The steady bleed of the class of 2021 bitcoin investors continues, as shown by the largest capitulation event in the history of bitcoin in terms of....

Related News

Capitulation and all-time high realized losses plague Bitcoing. What's really happening?

On-chain data shows the Bitcoin price has now once again dipped below the realized price, suggesting the bear market may not be over afterall. Bitcoin Earlier Broke Above Realized Price, But Has Now Fallen Back Again As pointed out by an analyst in a CryptoQuant post, the BTC price has re-entered into the historic bear […]

Data shows the net amount of losses being realized in the Bitcoin market is going down, but nonetheless remains at a high value. Bitcoin Net Realized Profit/Loss Still Has A Pretty Negative Value As per the latest weekly report from Glassnode, the net loss realization has reduced a bit recently, but the market is not near a neutral level of selling yet. The “net realized profit/loss” is an indicator that measures the net magnitude of profits or losses being realized by all investors in the Bitcoin market. The metric works by looking at the on-chain history of each coin being....

Bitcoin’s price action in the past two weeks has opened a new phase of stress among traders, with on-chain data showing realized losses climbing to heights last observed in 2022. Glassnode’s latest Week-On-Chain report shows Bitcoin is trading above an important cost-basis level but is also visibly straining under intensified loss realization, fading demand and weakening liquidity, which has placed short-term investors in a difficult position. Realized Losses Return To Deep Territory According to Glassnode, realized losses among Bitcoin entities have risen massively, and is now almost at....

Data from Glassnode shows more than $7 billion in Bitcoin losses was realized within three consecutive days, the most in the history of the crypto. Highest Ever Bitcoin Loss Realization Took Place During The Last Few Days Latest on-chain data released by Glassnode shows BTC investors took a heavy amount of losses in the past […]