This On-Chain Metric Suggests Bitcoin Not In Danger Of Another Sharp Drawdown

Historical data of an on-chain indicator could suggest Bitcoin may not be in danger of another sharp crash right now. Bitcoin Spot Exchange Depositing Addresses Stay At Very Low Values As pointed out by an analyst in a CryptoQuant post, signs are that another crash similar to Q3 2018 isn’t likely to happen currently. The relevant indicator here is the “spot exchange depositing addresses,” which is a measure of the total number of Bitcoin wallet addresses that are making send transactions to centralized spot exchanges right now. Generally, investors deposit their coins on....

Related News

Past trend of the Ethereum value captured per byte metric suggests that a 50% drawdown from here is still possible for ETH. Ethereum Value Captured Per Byte Currently Stands At $0.30, Double The Previous Bear Bottoms As per the latest data released by Glassnode, ETH may still possibly have potential for a further 50% plummet […]

On-chain data suggests Bitcoin whales who accumulated during the June crash have continued to hold strong so far. Bitcoin Sum Coin Age Distribution Shows Strong Accumulation Around $18k As pointed out by an analyst in a CryptoQuant post, the $18k level has been getting support from the whales as they have made spot purchases at this mark. The relevant indicator here is the “Sum Coin Age Distribution,” which tells us about the amounts the different Bitcoin investor groups are holding in their wallets right now. These groups are based on the idea of “coin age,” a....

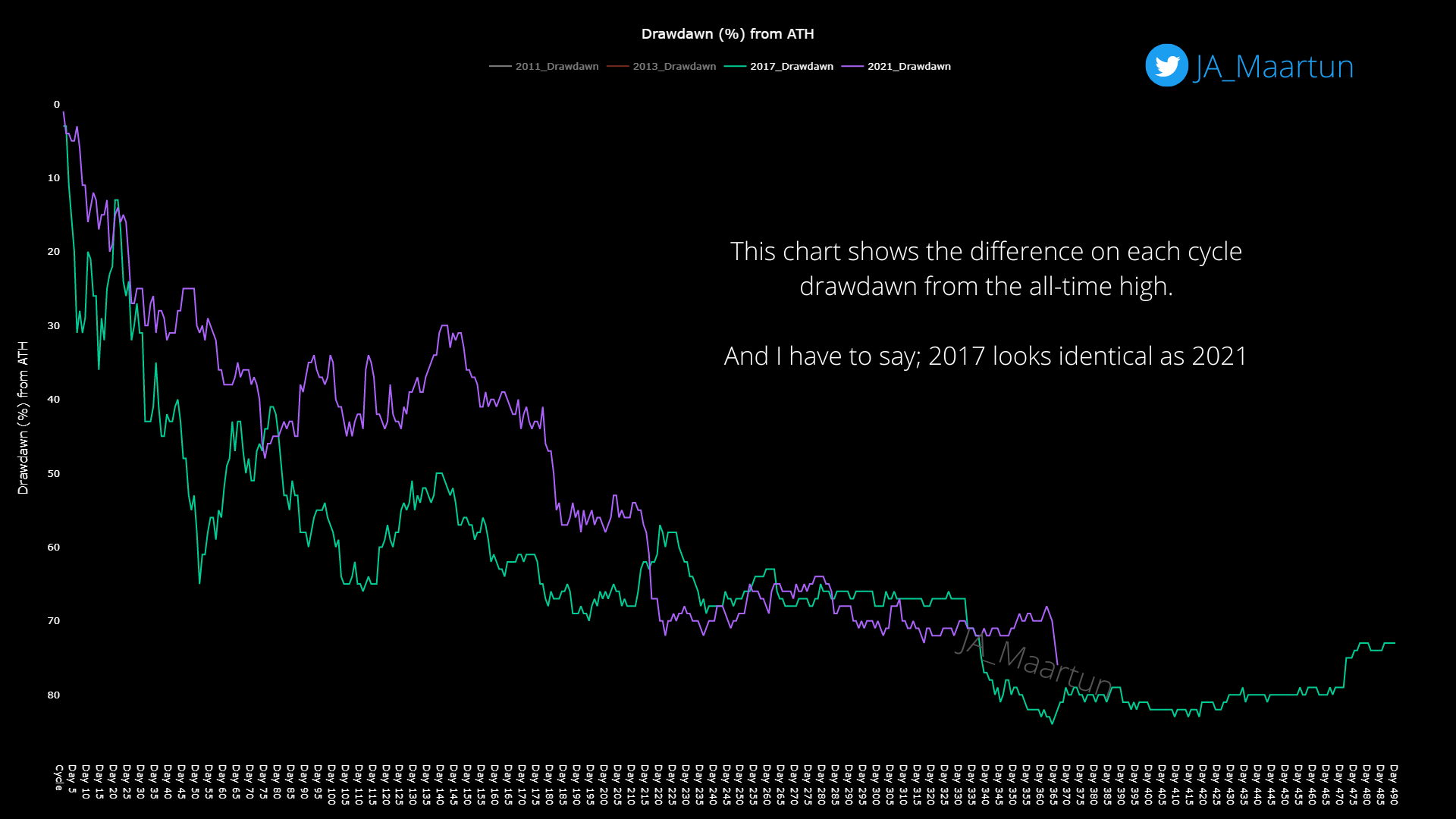

A quant has pointed out the similarities between the 2017 and 2021 Bitcoin cycles, something that could hint at how the rest of this bear market might play out. Both 2017 And 2021 Bitcoin Cycles Saw New Lows Around The 365-Day Mark Since The Top As explained by an analyst in a CryptoQuant post, the two cycles are more similar than one might expect them to be. The indicator of relevance here is the “drawdown from ATH,” which measures the percentage decrease in the price of Bitcoin following the all-time high during each cycle. Here is a chart that shows the trend in this metric....

As Bitcoin (BTC) edges closer to the psychologically significant $100,000 milestone, several technical and on-chain indicators suggest that a major breakout could be on the horizon. One such metric – Bitcoin’s Apparent Demand – has shown a strong rebound, signalling renewed interest and sustained accumulation in the market. Bitcoin Sees Sharp Rebound In Apparent Demand According to a recent CryptoQuant Quicktake post, contributor IT Tech pointed to a significant rise in BTC’s Apparent Demand. Most notably, this key indicator has returned to positive territory after spending....

On-chain data shows that Bitcoin miner exchange inflows have shot up recently, something that could extend BTC’s price drawdown. Bitcoin Miner To Exchange Flow Metric Has Seen A Spike As pointed out by an analyst in a CryptoQuant Quicktake post, miners are upping their selling pressure. The on-chain indicator of relevance here is the “Miner […]