Bitcoin Supply-Loss Chart Flashes Possible Bottom Signal — Is Reversal Emerging?

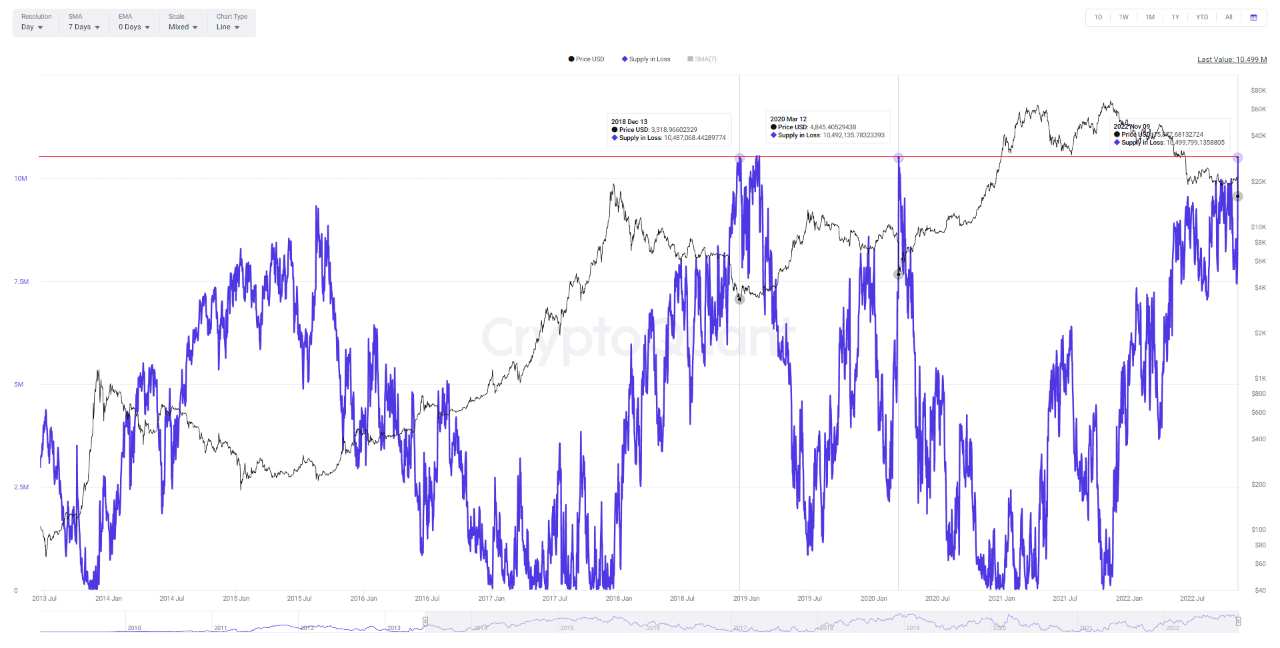

The cryptocurrency market has weathered a challenging period, testing the resolve of the most seasoned investors. After a prolonged period of downward pressure, the Bitcoin Supply-Loss Chart is flashing a possible bottom signal. A Deeper Look At Bitcoin Supply In Loss Chart Bitcoin on-chain data on the loss chart is currently flashing a possible bottom. In an X post, CryptosRus has revealed that the supply in the Loss metric chart tracks the total amount of BTC held by addresses where the current market price is below the average cost basis of those holdings. Essentially, the portion of....

Related News

A cryptocurrency analyst has pointed out how a rebound could be about to begin for XRP after the Tom Demark (TD) Sequential flashed a buy signal. TD Sequential Has Given A Buy Signal For XRP In a new post on X, analyst Ali Martinez has talked about a TD Sequential signal that has appeared on XRP’s 4-hour price chart. The TD Sequential refers to a technical analysis (TA) indicator that’s generally used for locating points of probable reversal in any asset’s price. The indicator involves two phases: the setup and countdown. In the first of these, it counts up candles of the....

On-chain data shows the amount of Bitcoin supply in loss has now reached levels similar to during the COVID crash and the 2018 bear market bottom. Bitcoin Supply In Loss Spikes Up Following The Latest Crash As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss has set a new record for this year following the FTX disaster. The “supply in loss” is an indicator that measures the total amount of Bitcoin that’s currently being held at some loss. This metric works by looking at the on-chain history of each coin in the circulating supply to see what price it....

A cryptocurrency analyst has pointed out how the Tom Demark (TD) Sequential has just given a buy signal on the weekly XRP price chart. TD Sequential Is Printing A Weekly Buy Signal For XRP In a new post on X, analyst Ali Martinez has talked about a TD Sequential signal that has appeared on the weekly XRP chart. The “TD Sequential” refers to an indicator from technical analysis (TA) that’s generally used for locating points of probable reversal in a given asset’s price. Related Reading: Ethereum Speculators Add $654M In Bets As Price Plunges To $2,800 It involves two....

Bitcoin price this week blasted off from $30,000 to $40,000 in a 25% move. Although the momentum was provided by an epic short squeeze, the leading cryptocurrency by market cap could continue to run much higher if diagonal downtrend resistance is broken. The breakout would confirm what looks like a bump-and-run reversal bottom, which according to the authority in chart patterns, has the best bull market performance out of 39 other chart patterns. Could this be the signal that bulls have been waiting for to restart their charge? Bitcoin Bulls Could Be Ready To “Bump And Run”....

On-chain data shows Bitcoin is currently not satisfying a condition that has historically occurred alongside major bottoms in the price. Bitcoin Supply In Profit Is Still Greater Than Supply In Loss In a new post on X, James V. Straten, a research and data analyst, has pointed out how BTC isn’t fulfilling the bottom condition for the supply in profit and loss metrics. The “supply in profit” here naturally refers to the total amount of Bitcoin supply currently carrying an unrealized profit. Similarly, the “supply in loss” keeps track of the number of underwater....