Bitcoin OG Whale Deposits 5,252 BTC And Doubles Down With a 2,100 BTC Short

Bitcoin is struggling to reclaim higher levels as selling pressure intensifies and fear continues to dominate market sentiment. After weeks of volatile price action, the market’s recovery attempts are being met with heavy resistance, with BTC still trading below key psychological levels. According to data from Lookonchain, the well-known trader known as the BitcoinOG (1011short) […]

Related News

Bitcoin has undergone some shaky price action after a push to $19,000 this past week. Ki Young Ju, CEO of Crypto Quant, recently said that the coin could face a correction in the days and weeks ahead. The percentage of whale deposits relative to retail deposits into Coinbase addresses has increased, he noted. Bitcoin Could See Price Drop As Whale Deposit Ratio Spikes Bitcoin has undergone some shaky price action after a push to $19,000 […]

A swift recovery from Bitcoin and altcoins are signals that BTC may have bottomed at $17,650. Bitcoin's (BTC) sharp correction to $17,650 came as no surprise to investors and many expected the digital asset to fall as low as $16,000. Thus, the quick recovery back to $18,600 is intriguing and it bolsters the popular belief that retail and institutional investors are keen to purchase every BTC dip. Although the possibility of another drop remains, three factors point toward a Bitcoin bottom at $17,650. The factors are, whale deposits hitting a peak, BTC posting a quick recovery, and trading....

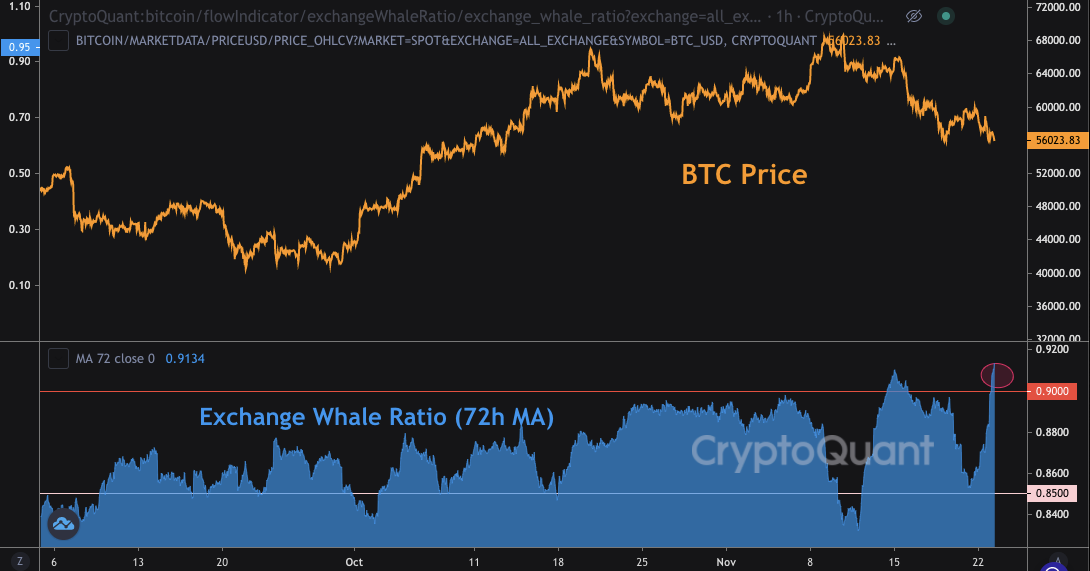

Data shows Bitcoin whales now account for 91% of the deposits going to exchanges, a trend that could be a bearish signal. Bitcoin Exchange Whale Ratio Surges To 91% As pointed out by a CryptoQuant post, the BTC all exchanges whale ratio has now risen to 91%, a historically bad sign for the crypto. The […]

Bitcoin price spikes continue as data reveals exchange activity is anything but flat this week. Bitcoin (BTC) whales are moving large amounts of coins to exchanges in tandem with large outflows, curious new data shows. According to the exchange whale ratio indicator from on-chain analytics firm CryptoQuant, large transactions have accounted for over 90% of recent exchange deposits.Top 10 deposits make up 90% of exchange inflowsIn a marked change from previous behavior, over the past week, whales have become much more active prospective sellers on exchanges.The exchange whale ratio, which....

Bitcoin deposits into exchanges have become a popular on-chain data point, but some say this metric can be misleading. Traders are increasingly checking on-chain data to "predict" both the short-term and long-term price trend of Bitcoin (BTC) using such platforms as CryptoQuant, Glassnode and WhaleAlert. Particularly, data points such as Bitcoin exchange inflows and outflows and stablecoin inflows are actively used by traders to anticipate where BTC may go next. 499 #BTC (29,979,163 USD) transferred from unknown wallet to #Coinbasehttps://t.co/zkhywRQS82— Whale Alert (@whale_alert) March....