These 3 metrics suggest the Bitcoin price crash is not over

$20,000 feels scary, but it may not be the end of the story for Bitcoin’s latest bear cycle. Bitcoin (BTC) near $20,000 is worrying the market, but after narrowly avoiding breaking support, is the worst really over?According to multiple on-chain indicators, it seems that max pain has yet to arrive this cycle.The stakes are high for many hodlers this week — almost 50% of the supply is being held at a loss and miners are upping their shipments of BTC to exchanges.Even some of Bitcoin’s biggest investors, notably MicroStrategy, are having to defend their conviction on BTC as price action....

Related News

Bitcoin’s price action is still above the $100,000 threshold and within striking distance of its all-time high at $111,700, but its on-chain activity tells a completely different story. According to the latest report from on-chain analytics firm Glassnode, even though Bitcoin’s price is pushing to new heights, underlying blockchain metrics have slipped into territories more […]

The bear market is far from over, but according to Glassnode, several metrics suggest that Bitcoin capitulation already occurred. “When will it end?” is the question that is on the mind of investors who have endured the current crypto winter and witnessed the demise of multiple protocols and investment funds over the past few months.This week, Bitcoin (BTC) once again finds itself testing resistance at its 200-week moving average and the real challenge is whether it can push higher in the face of multiple headwinds or if the price will trend down back into the range it has been trapped in....

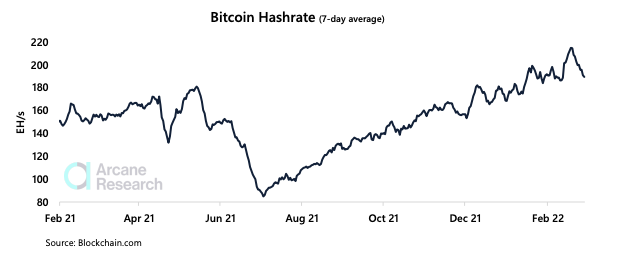

Bitcoin remains in the red with a 10% loss over the past week. The number one crypto by market cap has been consolidating at its current levels after a massive crash too it to a multi-year low of $17,500. Related Reading | Are Small Cap Crypto Assets Rebounding A Sign Risk Appetite Returning? At the time of writing, BTC’s price trades at $20,400 with sideways movement in the last 24 hours. As many outlets have been reporting, Bitcoin miners have been reducing their BTC holdings. This has contributed to the selling pressure and to BTC’s price plunging to its current levels from the....

“No doubt about it, people are really scared, which is typically [...] an opportunity to buy,” Willy Woo said. Bitcoin analyst and co-founder of software firm Hypersheet Willy Woo believes that on-chain metrics show that BTC is not in a bear market despite observing “peak fear” levels. Speaking on the What Bitcoin Did podcast hosted by Peter McCormack on Jan. 30, Woo cited key metrics such as a strong number of long term holders (wallets holding for five months or longer) and growing rates of accumulation suggest that the market has not flipped the switch to bear territory:“Structurally....

Bitcoin remains on an upward trend after breaking through $40,000 once again. However, this upward trend has not translated onto on-chain metrics. While the price of the digital asset continues to sit in the green, on-chain metrics have plummeted paining an entirely different picture in relation to price. From miner revenues to transaction fees, the […]