Bitcoin’s Historical Liquidity Indicator Just Lit Up — Big Move Incoming?

According to an analyst, Bitcoin sits in a liquidity set-up that has shown up before big rallies. Prices are not shooting higher yet. At press time Bitcoin trades around $104,500, down 0.5% over the past day. Related Reading: XRP’s Next ‘Face-Melting’ Rally Could Hit Within 6 Weeks—Analyst Traders watched a decline of about 1.8% earlier that pushed the price near $103,400 and it briefly touched $102,850 during the move. Stablecoin Signal Points Toward Accumulation CryptoQuant analyst Moreno points to the Stablecoin Supply Ratio, or SSR, as the first clear indicator. The SSR compares....

Related News

Data shows the Bitcoin supply in profit has continued its decline, but the metric has still not reached levels as low as the previous bear market bottoms. Around 50% Of The Bitcoin Supply Is In Profit At The Moment According to the latest weekly report from Glassnode, the current profitability levels in the BTC market are still above the 40%-42% values that were observed during historical bottoms. The “percent supply in profit” is an indicator that measures the total percentage of the Bitcoin supply that’s currently holding some unrealized profit. The metric works by....

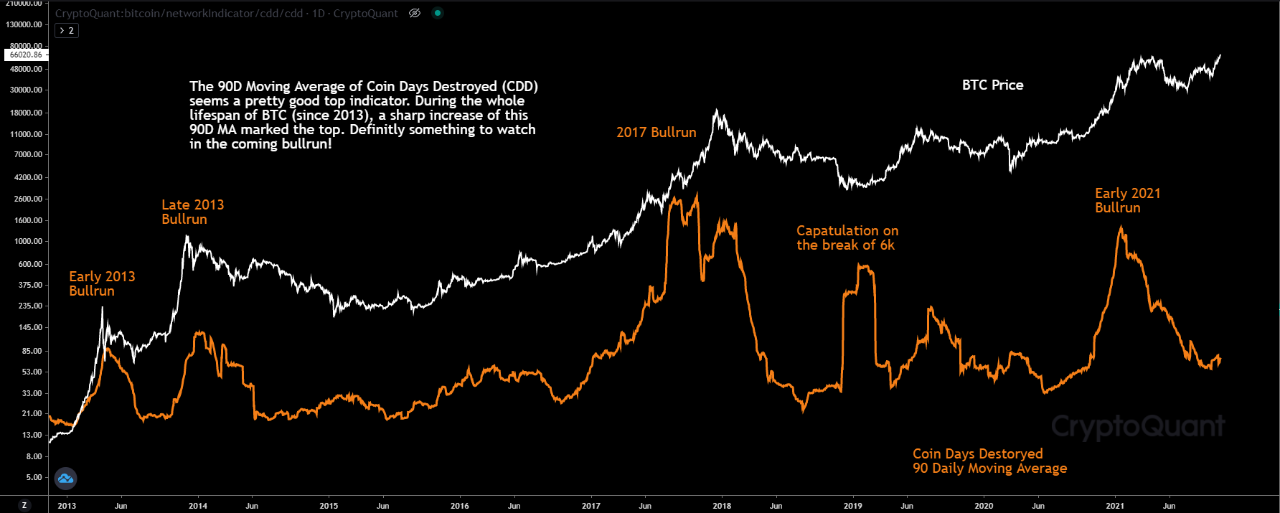

Historical data of the “coin days destroyed” indicator versus the Bitcoin price may suggest the metric can help predict tops. The Bitcoin Coin Days Destroyed (CDD) Indicator As explained by an analyst in a CryptoQuant post, the coin days destroyed metric might be a reliable indicator for BTC tops. A “coin day” is defined as […]

Head of Macro Research at Global Market Investor Julien Bittel has provided an interesting insight into the Bitcoin market following a major price loss in the past week. In a bold move, the financial analyst has backed the premier cryptocurrency to soon pull off a rebound linking the recent price fall to broader macroeconomic conditions. […]

The Hash Ribbon indicator—an on-chain metric designed to identify periods of miner capitulation and subsequent recovery—has just issued a bullish signal for Bitcoin. Several well-known figures within the BTC community highlighted the event through posts on X , suggesting that the signal could mark a turning point in the market. The Ultimate Bitcoin Buy Signal? First introduced by on-chain analyst Charles Edwards, the Hash Ribbon relies on two moving averages (commonly the 30-day and 60-day averages of Bitcoin’s hash rate) to determine when mining difficulty and hash power may have....

Bitcoin has plenty of room to rally, according to a fundamental analysis indicator that flagged the price bottom in March.