Best Altcoins to Buy as Bitcoin Hits $120K and JPMorgan Targets $165K

JPMorgan has just dropped a bold target for $BTC: $165K. The firm cited gold’s record-setting run and the growing ‘debasement trade’ as tailwinds. At the same time, Uptober is living up to its name, with Bitcoin blasting through $120K despite the U.S. government shutdown, proving just how resilient this market has become. Historically, when Bitcoin asserts dominance like this, it doesn’t take long for capital to rotate into the best altcoins, as that’s often where the larger gains emerge. With momentum building, hot alternatives like Bitcoin Hyper ($HYPER), Best Wallet Token ($BEST), and....

Related News

Bitcoin’s blue-chip coverage just turned decisively bullish. Within hours of each other on October 2, JPMorgan and Citi outlined upside paths that put six-figure levels squarely on the 12-month horizon, framing the next phase of the cycle around volatility normalization versus gold and sustained institutional demand. New 12-Month Bitcoin Calls From Citi And JPMorgan JPMorgan […]

Bitcoin is back in beast mode. After months of chop and doubt, $BTC has flipped the narrative with a powerful V-shaped recovery that has it trading above $103K. Market sentiment has turned sharply bullish, and it’s not just crypto-native voices shouting ‘to the moon.’ Big money is flowing in. Analysts are calling for a $120K […]

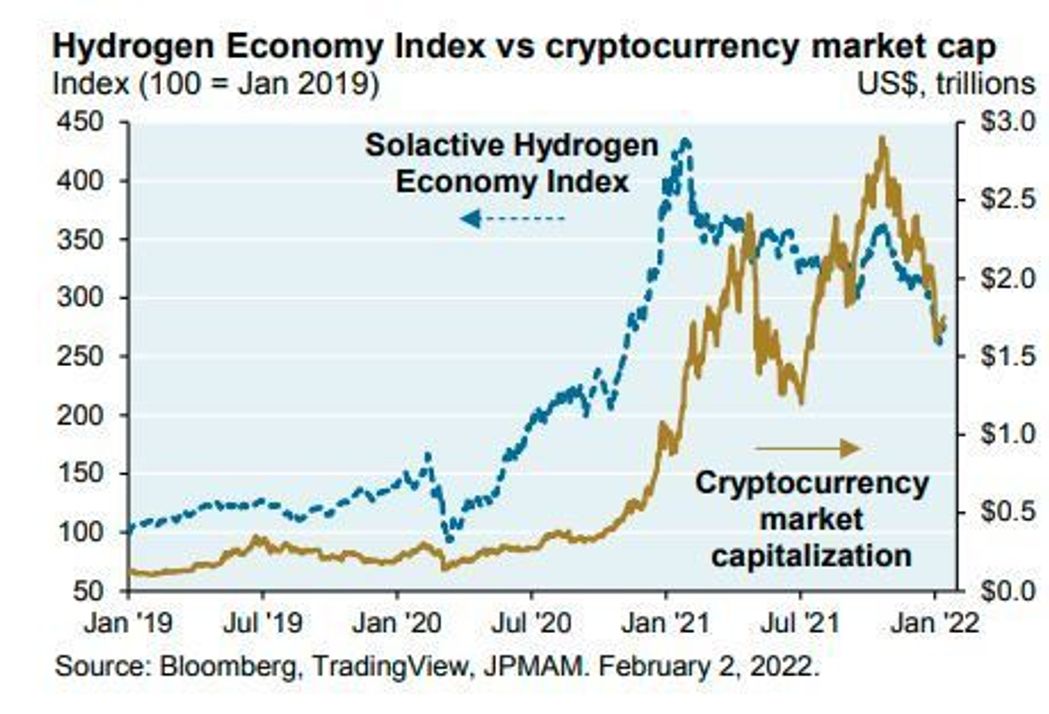

JPMorgan’s chairman of investment strategy, Michael Cembalest, is wary of bitcoin and other cryptocurrencies. The JPMorgan strategist stated in a column published Feb. 3 that his comments were his own and not those of JPMorgan Chase. JPMorgan Strategist Raises Issues With Crypto Market While much of the United States recovers from last week’s terrible winter […]

Quick Facts: ➡️ Bitcoin’s rebound toward $93k, driven by ETF inflows and Fed rate cut expectations, has put renewed focus on a possible $120k target. ➡️ US spot Bitcoin ETF inflows have hit $58.5M on December 2 alone, while $BTC has added $732B in new capital throughout the entire cycle. ➡️ Bitcoin Hyper ($HYPER) proposes […]

JPMorgan has offered its view on the bitcoinization of El Salvador, the country which recently made bitcoin legal tender alongside the U.S. dollar. JPMorgan says, “It is difficult to see any tangible economic benefits associated with adopting bitcoin as a second form of legal tender.” JPMorgan on the Bitcoinization of El Salvador JPMorgan & Chase’s Latin American research team published a report titled “The Bitcoinization of El Salvador” Thursday. El Salvador recently passed legislation making bitcoin legal tender alongside the U.S. dollar. The JPMorgan....