Bitcoin Futures Pressure Score Hits 18%: Shorts Are Losing Momentum

Bitcoin is once again at a decisive moment after several days of tight consolidation around the $110K level. Bulls are making an effort to defend this critical support, while also eyeing the $113K resistance as the next key barrier. A breakout above it could provide the momentum needed for BTC to retest higher supply zones and reignite bullish sentiment. However, the market remains fragile, with volatility and fear weighing heavily on investor confidence. Related Reading: Bitcoin CDD Indicator Signals LTH Distribution As Demand Offsets Pressure Top analyst Axel Adler provided important....

Related News

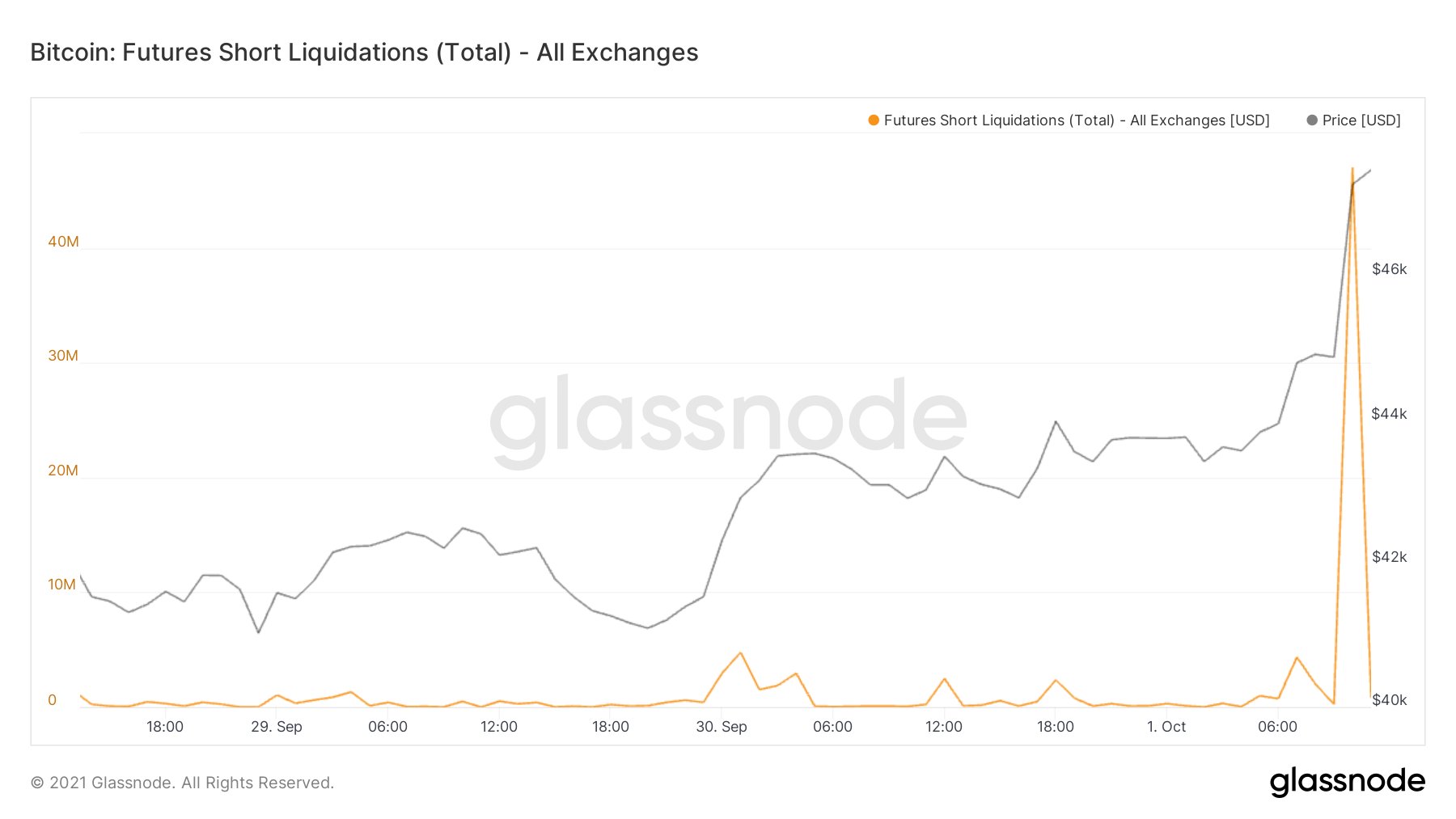

After today’s incredible Bitcoin move where the price climbed to $47.5k, shorts worth around $47 million liquidated within an hour. $47,000,000 In Bitcoin Futures Shorts Liquidate Within Just An Hour As pointed out by an analyst on Twitter, around $47 million in Bitcoin futures shorts have liquidated within an hour today. If you don’t know […]

Bitcoin is at a crossroads after failing to reclaim higher supply levels, raising concerns among investors about the strength of its current trend. The price has slipped below key demand zones, and bullish momentum is showing signs of exhaustion. For now, traders are watching closely as the market decides whether BTC can recover or if […]

Bitcoin perpetual futures buyers are paying a 5.4% weekly funding rate to keep their positions open, but is this sustainable? Today Bitcoin (BTC) price rallied to a new all-time high at $44,900 shortly after Tesla announced a $1.5 billion investment. This event triggered $555 million worth of shorts to be liquidated in two hours and it happened as Bitcoin futures open interest reached $13.7 billion, which is just 3% below its historical high.These price moves drastically increased the cost of carrying long positions, mainly for those using perpetual futures. This indicator raised a yellow....

Despite a bounce in the price of Bitcoin back to the $104,000 mark, bearish pressure still lingers heavily around the flagship crypto asset. BTC’s recent market turbulence and strong pullback have triggered a surprising shift in its market dynamics, as evidenced by a sharp decrease in the BTC Bull Score Index. Bullish Momentum Vanishes As […]

Although Ethereum (ETH) is still up approximately 80% over the past three months, the second-largest cryptocurrency by market cap appears to have lost its momentum lately, down 0.6% over the past month. Binance Ethereum Trading In Neutral Zone According to a CryptoQuant Quicktake post by contributor Arab Chain, Ethereum trading on Binance during September 2025 is witnessing a period of relative calm compared to other months. Notably, there has been a decline in the imbalance between ETH spot and perpetual volumes. Related Reading: Ethereum Staking Hits Record 36 Million ETH, Driving....