Bitcoin Trend Constructive As Long As This Metric Holds, Glassnode Says

On-chain analytics firm Glassnode has explained how the Bitcoin price trend remains constructive as long as the asset trades above the short-term holder cost basis. Bitcoin Is Still Maintaining Above Short-Term Holder Realized Price In a new post on X, Glassnode has discussed about the Realized Price of the Bitcoin short-term holders. The “Realized Price” here refers to an indicator that keeps track of the cost basis of the average investor or address on the BTC network. Related Reading: Bitcoin Bull Score Sees Sharp Jump, No Longer Signals Bear Phase When the value of the....

Related News

Bitcoin has observed a recovery surge toward $117,000 as on-chain data shows Binance users have been making consistent withdrawals recently. Binance Bitcoin Netflow Has Been Negative Recently As pointed out by CryptoQuant community analyst Maartunn in a Quicktake post, BTC has been flowing out of Binance recently. The on-chain indicator of relevance here is the “Exchange Netflow,” which keeps track of the net amount of Bitcoin that’s entering into or exiting out of the wallets connected to a given centralized exchange. When the value of this metric is positive, it means....

Data released by Glassnode suggests Bitcoin long-term holder behavior has shifted from accumulation to distribution recently. Bitcoin Long-Term Holders Have Shed 222k Coins Off Their Stack Since May As per a new report from Glassnode, the BTC long-term holders have been spending up to 47k BTC per month in recent days. The “long-term holders” (or LTH in short) refer to the cohort of Bitcoin investors that have been holding onto their coins since at least 155 days ago, without selling or moving them. The “LTH net position change” is an indicator that measures the net....

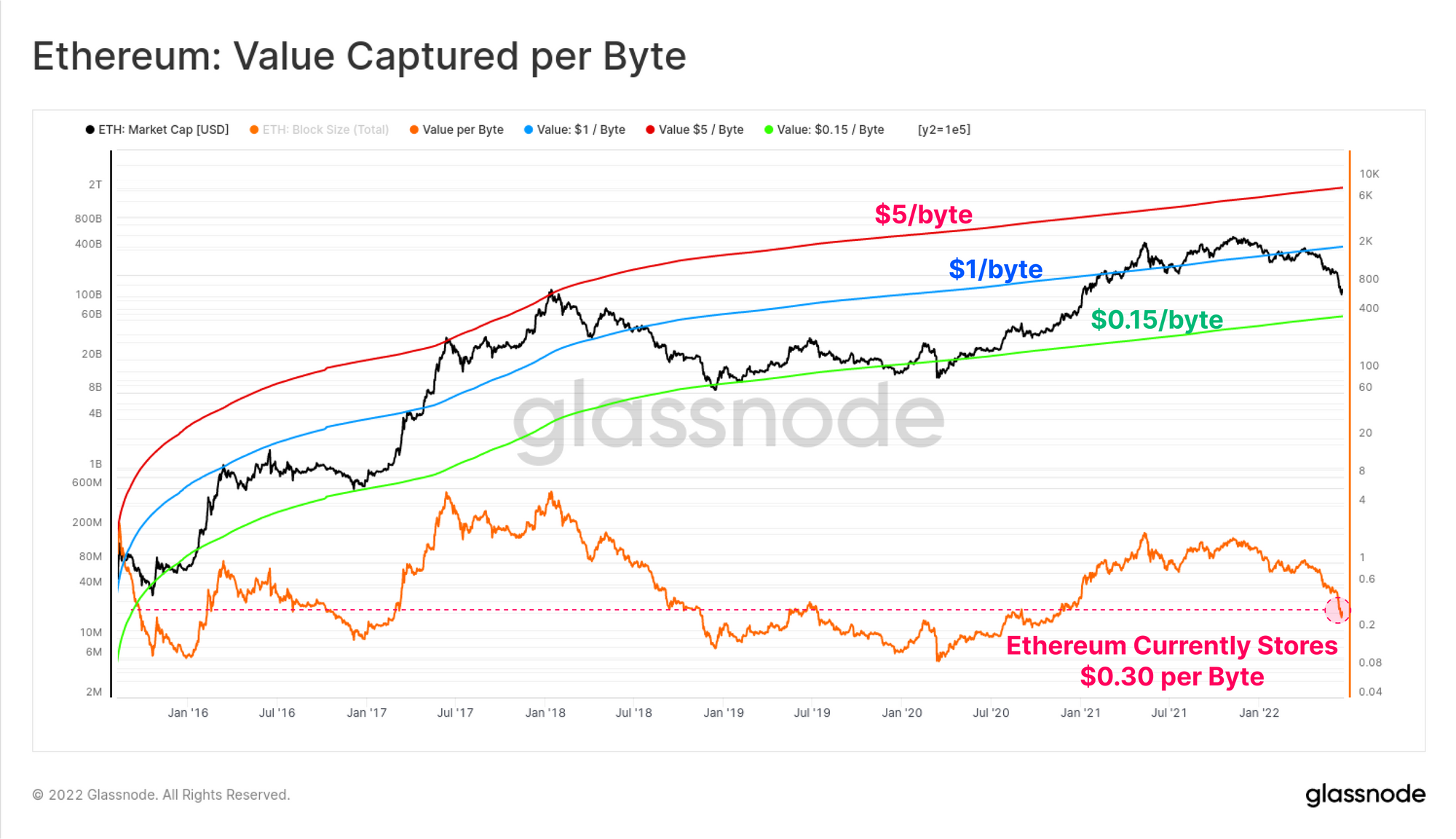

Past trend of the Ethereum value captured per byte metric suggests that a 50% drawdown from here is still possible for ETH. Ethereum Value Captured Per Byte Currently Stands At $0.30, Double The Previous Bear Bottoms As per the latest data released by Glassnode, ETH may still possibly have potential for a further 50% plummet […]

Data from Glassnode shows the recent selling from Bitcoin long-term holders has come from those who bought at more recent prices, and not the hodlers who got in during the 2017-2020 cycle. Bitcoin Long-Term Holders Have Been Selling At An Average Loss Of 33% As per the latest weekly report from Glassnode, the BTC long-term holder SOPR has had a value of less than one during recent weeks. The “spent output profit ratio” is an indicator that tells us whether Bitcoin investors are selling at a profit or at a loss right now. When the value of the ratio is greater than one, it means....

It's a slow grind for long-term holders with no significant macro top or bottom in sight, the Reserve Risk metric suggests. Bitcoin (BTC) investors are famous for their ability to "hodl" through price dips, but new data sheds light on how long they may be prepared to continue.In a tweet on Jan. 16, on-chain analytics firm Glassnode noted that holder behavior currently mimics how Bitcoin behaves during the least extreme part of its price cycles.Reserve Risk: Bitcoin price ‘depressed,’ hodlers hodl onReferring to its Reserve Risk ("R-Risk") metric, Glassnode argued that current buying and....