Bitcoin price bounces off $42K as order book imbalance turns 'crazy'

No challenge of $40,000 yet as analysis reveals that active bears are selling into a black hole. Bitcoin (BTC) briefly touched $43,000 prior to Wall Street opening on Jan. 6 as new market analysis offered bad news for bears. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView"Very similar to $30,000"Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it ranged after hitting its lowest levels in nearly six weeks.Amid six-month lows for sentiment and a feeling of foreboding on social media, analysis investigating trader behavior nonetheless concluded that all is....

Related News

Almost 30,000 Bitcoin leaves major exchanges in a single day as buyers copy miners in taking the BTC supply off the market. Bitcoin (BTC) investors are voting with their wallets as one-day outflows from major exchanges near 30,000 BTC. Data from on-chain analytics firm CryptoQuant shows that on Jan. 11, 29,371 BTC left exchange order books — the most since Sep. 10.The four-month high in outflows corresponds to short-term optimism returning on Tuesday as BTC/USD bounced and maintained levels above $42,000.The pair subsequently went on to hit local highs of $43,150 before consolidating, this....

Exchanges play a central role in the bitcoin ecosystem. In addition to facilitating trade, they set exchange rates between bitcoin and fiat currencies such as the US dollar or the euro. Rates can vary widely from exchange to exchange (which is where the arbitrageurs come in) and from minute to minute (where the other traders enter). By now, long-time bitcoin traders are well acclimatised to this volatile landscape. Take, for example, the wild price swings at the middle of this month. From a high of $596.00 on 8th August, the price tumbled 15% to a low of $503.96 just six days later. But....

In the chaotic aftermath of last week’s market-wide wipeout, one granular forensic stands out: order-book depth on major venues thinned to “air,” letting relatively modest market orders rip through price levels with almost no resistance. The phenomenon, captured by independent market analyst Dom (@traderview2) on X, is now central to a stark takeaway for XRP: under the same microstructure conditions, price can mechanically gap as easily to $1.19 as to $20. It is not a forecast; it’s a statement about how quotes, liquidity, and matching engines behave under stress. XRP Price May Gap To....

In early November we talked about a brand-new exchange soon opening its doors, based in New York City, Coinsetter. At the time it was noted that the Coinsetter order book would be integrated with Bitstamp's, and at last, it has. Coinsetter today announced that the activation of the Bitstamp integration is complete, and is available to the site's small group of beta testers. "We are excited to announce that we have integrated Bitstamp's order book into Coinsetter, which brings a deep source of liquidity to traders on our platform," the company said in the announcement. "Our partnership with....

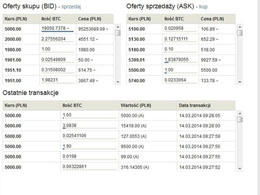

Some 9 hours ago, astute Bitcoiners watching Bitcoin exchange charts were greeted by a surprising blip on Poland's largest Bitcoin Exchange: Bitcurex. Bitcurex has been in operation since July 2012, and is operated out of Lodz, Poland under the registered Digital Future Ltd. It seems that a hacker managed to create 94 million PLN (The Polish Zloty) and used the fiat to buy Bitcoin orders on the order book. According to witness reports from traders on Bitcurex at the time, the hacker used his hacked PLN to buy the order book and caused a noticeable ~10% change in the exchange rate. The....