Is The US Planning To Use XRP To Clear Trillion-Dollar Debt? New Developments...

XRP has entered a shocking new phase of development, with reports confirming its ledger’s use in debt tokenization. This development comes when the United States (US) faces a multitrillion-dollar debt problem, drawing attention to the XRP Ledger’s (XRPL) potential role in modernizing how debt is managed and settled on a larger scale. As adoption for XRPL accelerates, its integration into debt-related infrastructure highlights how blockchain technology is beginning to intersect with the world’s largest financial challenges. XRP Ledger: A Potential National Debt Solution Crypto analyst....

Related News

US President Donald Trump recently stated that cryptocurrencies could be used to alleviate the ballooning US national debt, which has recently exceeded $38 trillion. Trump’s statement has triggered a global conversation about the role of digital assets, especially Bitcoin (BTC), in addressing the US’s debt crisis. Can Bitcoin Be Used To Clear The US’ National […]

The latest grim milestone for the U.S. economy means that its national debt total is now 4,000% larger than the Bitcoin market cap. The United States’ national debt has passed $30 trillion — and even all the Bitcoin (BTC) in the world would hardly touch it.According to the latest official statistics, U.S. national debt is at levels never seen before, passing the psychological $30-trillion barrier for the first time this week.Bitcoin is worth less than 3% of U.S. national debtAfter two years of liquidity injections fuelled by issuing even more debt, the Federal Reserve is attempting to rein....

The Institute of International Finance (IIF) says global debt will soar to a record $277 trillion by the end of 2020 as governments and companies continue to spend in response to the COVID-19 pandemic. Already, the debt has ballooned by $15 trillion this year to $272 trillion through September. Governments from developed markets account for more than half of that increase, according to the IIF’s Global Debt Monitor. Governments from Developed Markets Are the Biggest Borrowers According to a report, debt repayments will prove to be “much more onerous” despite the....

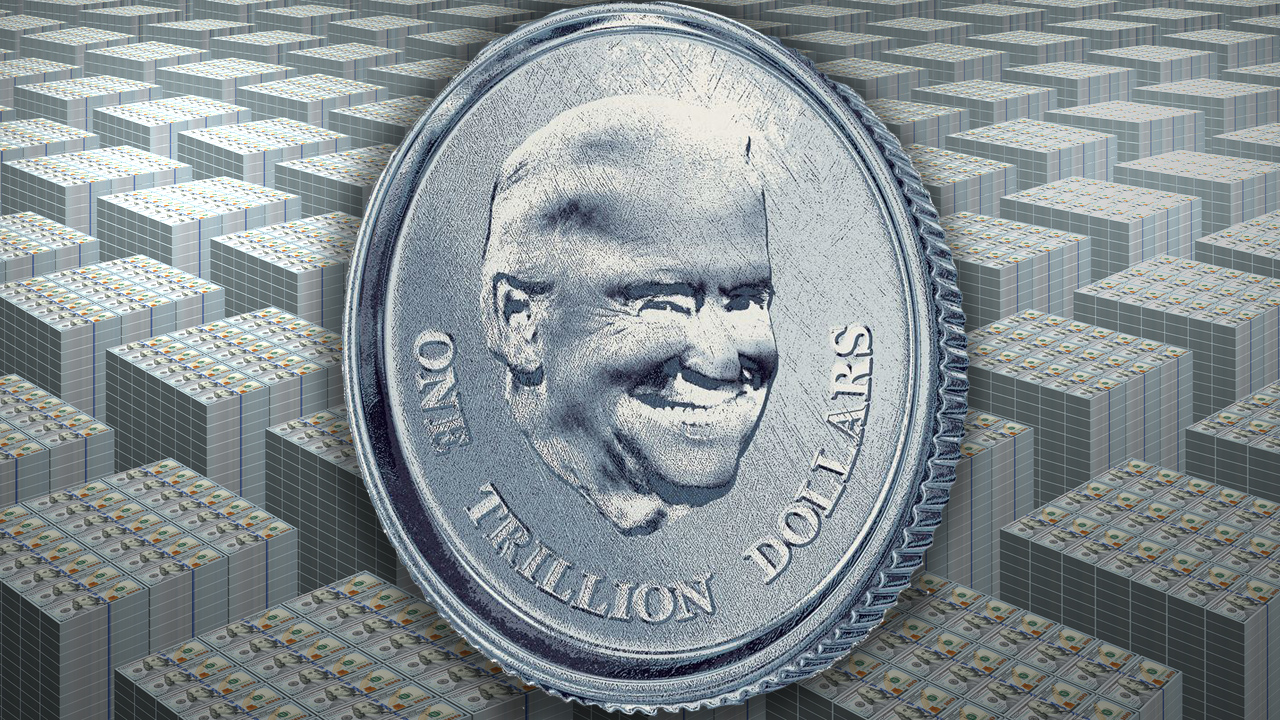

American politicians have been clamoring about the U.S. facing a significant debt crisis and the debt ceiling putting the country at risk of default. Joe Biden spoke about the debt ceiling and told Republicans to “just get out of the way” when it comes to the decision. Meanwhile, a number of U.S. bureaucrats are floating the idea of minting a $1 trillion platinum coin in order to magically bolster the treasury with cash. Trillion-Dollar Coin Concept Strongly Considered by US Politicians, Former US Mint Director Says Platinum Coin Can Be Minted in Mere Hours Simply creating....

It is time to reveal the top five reasons why bitcoins are superior to dollars, both now, and in the future. I’ve limited this list to the top five, but there are certainly many other reasons. The dollar has its own advantages, but they will prove fleeting in the coming years. The dollar’s reign as the world’s global reserve currency is running out, and bitcoin’s time as the world’s first and only global digital currency is just beginning. Here are five reasons why. Inflation occurs partly due to the number of currency units in circulation. U.S. dollar circulation continues to increase at....