XRP Tops All Assets On Risk/Reward, Analyst Says

XRP sits at a crossroads. Trading around the $1.6 area after a steep run higher and a later pullback, the token now rests on a weekly support band that traders are watching closely. According to crypto analyst Scott Melker, this is one of the cleaner risk/reward setups in crypto right now — a small stop can limit losses while a bounce could offer meaningful gains. Related Reading: Crypto Funds Bleed $1.80 Billion As Metals Rally Heats Up Support Zone Holds The Key Based on reports, the zone around $1.55 to $1.60 is important. It lines up with the midpoint of the breakout that began in....

Related News

A new technical analysis is suggesting that Dogecoin’s current rally may still have room to grow. According to crypto analyst Kevin, the historical risk levels that usually mark cycle tops are currently nowhere near flashing red for Dogecoin. Chart analysis of Dogecoin’s historical risk levels shows that the meme coin is still sitting in what looks like a mid-cycle phase, and the kind of overheated price action that preceeds exhaustion has not yet appeared. Dogecoin Historical Risk Levels Point To More Upside Kevin’s latest post on the social media platform X showcased Dogecoin’s....

Bitcoin is emerging as a unique asset class, according to a recent report by Chris Burniske, blockchain analyst and products lead at Ark Invest, and Adam White, vice president of business development and strategy at Coinbase. In their report, titled “Bitcoin: Ringing the Bell for a New Asset Class,” the authors argue that bitcoin is investable but differs significantly from other assets in its politico-economic profile, price of independence, and risk-reward characteristics. They believe cryptocurrency’s open source software will differentiate it further from other asset classes. They....

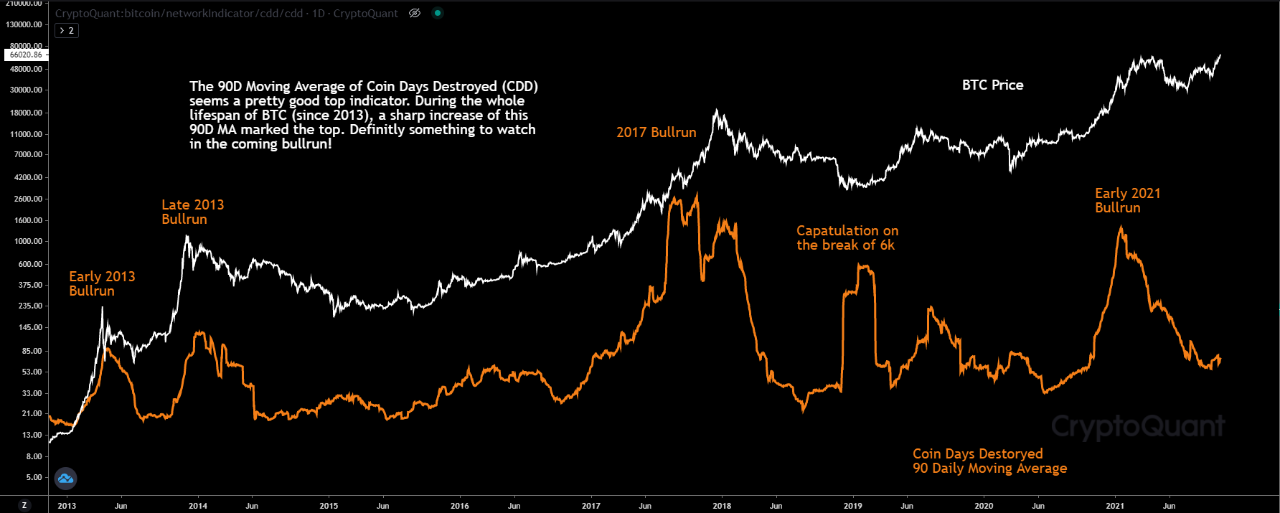

Historical data of the “coin days destroyed” indicator versus the Bitcoin price may suggest the metric can help predict tops. The Bitcoin Coin Days Destroyed (CDD) Indicator As explained by an analyst in a CryptoQuant post, the coin days destroyed metric might be a reliable indicator for BTC tops. A “coin day” is defined as […]

Block.one holds a reported 140,000 BTC which is worth around double the EOS market cap. Does that make EOS a buy? EOS has largely under performed during this crypto rally and has dropped out of the top ten by market cap, but one industry executive believes it could be one of the best risk/reward digital assets right now.Chartered Financial Analyst and Arca CIO Jeff Dorman made the assertion based upon Block.one’s extensive Bitcoin holdings.Before delving into that, Dorman observed that EOS is the only major crypto asset apart from XRP that has not made significant gains during this rally.....

Crypto analyst Doctor Profit has revealed the next Bitcoin price level he is looking to accumulate at in anticipation of a relief rally. Despite plans to buy BTC, the analyst indicated that he is still bearish on the flagship crypto in the long term, with a larger decline expected to unfold. Analyst Reveals The Next Buy Level As Bitcoin Price Eyes Bounce In an X post, Doctor Profit stated that he is buying BTC around $86,000 as he looks to trade a short-term relief bounce. He reiterated that he sees the probability of the Bitcoin price revisiting the $97,000 to $107,000 region before the....