Bitcoin Treasury Premium At Risk — What Could This Mean For BTC Price?

Bitcoin (BTC) treasury companies are facing a rather critical situation as their market premium over underlying BTC holdings erodes amid falling volatility and a sharp slowdown in new purchases. Notably, monthly BTC purchases by these companies have crashed by 97% since November 2024, reflecting a highly cautious market approach in recent months. However, recent data […]

Related News

The price of BTC could be stuck in consolidation for longer than initially anticipated, as the latest on-chain data shows that the Bitcoin Coinbase Premium Index has dropped back beneath zero. What does this dwindling metric signal for the premier cryptocurrency? Is The Bitcoin Price At Risk Of Downward Movement? In a recent post on […]

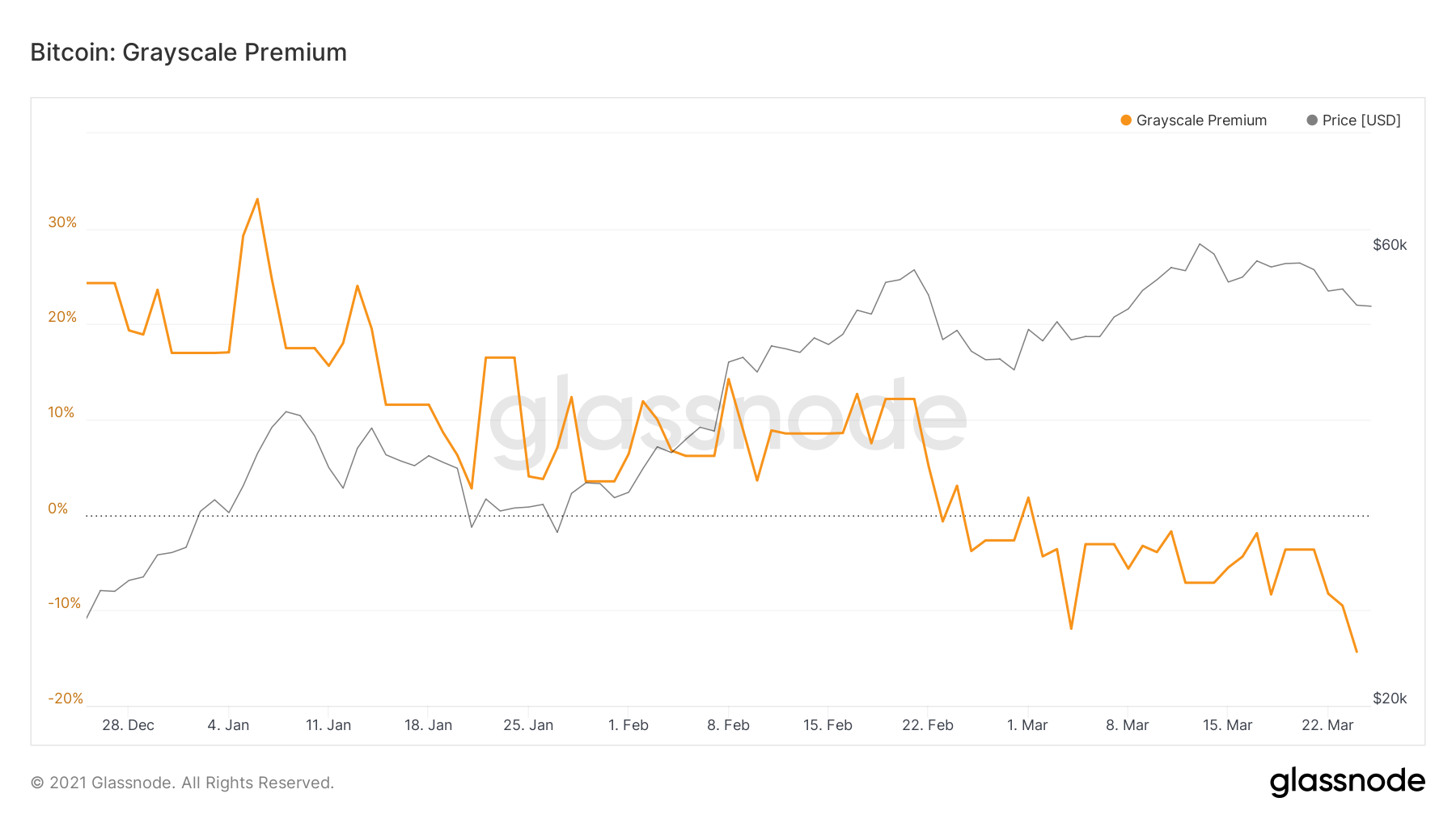

Following the recent bitcoin price pullback, the latest Skew data now indicates that the premium rate on Grayscale’s GBTC is under 10%. The lower rate comes just weeks after the premium peaked at 41% towards the end of December. The GBTC premium is a measure of the extent of differences in the value between the crypto asset on the open market and in the Grayscale fund. The same data also shows that between late October of 2020 and January 21 of the current year, this premium averaged 22%. However, in the seven days leading up to January 21, this rate dropped to 7.3%. According to....

Data shows the Bitcoin Coinbase Premium Gap has plunged into the negative territory following BTC’s latest high above $98,000. Bitcoin Coinbase Premium Gap Has Just Observed A Plummet As explained by CryptoQuant community analyst Maartunn in a new Quicktake post, the recent positive Coinbase Premium Gap has just disappeared. The “Coinbase Premium Gap” here refers […]

Since trading at a negative for nearly 2 months, GrayScale Bitcoin Trust (GBTC) premium plummeted to -14.21% this morning. Historically, GBTC has traded at a high premium relative to the underlying Bitcoin, commanding an average of 15.02% premium since the fund’s inception. But as competition grows and firms create cheaper, more accurate financial products, GBTC’s appeal has dropped dramatically — and its premium clearly shows for it. Analyzing Why Grayscale Bitcoin Trust Premium Continues to […]

Trading Bitcoin options can be a great way to access leverage while avoiding the liquidation risk presented by futures contracts but investors must keep an eye on the premiums. The most basic Bitcoin (BTC) options contracts involve buying a call which gives the holder the opportunity to acquire the asset at a fixed price on a set date. For this privilege, the buyer simply pays an upfront fee, known as a premium, to the contract seller.Although this is a great way to use leverage while avoiding the liquidation risk that comes from trading futures contracts, it comes at a cost. The options....