Pro traders avoid Bitcoin longs while cautiously watching DXY strengthen

Large corporations are buying Bitcoin at an accelerating pace, but pro traders are reluctant to open BTC longs while the dollar index strengthens. Bitcoin (BTC) price might have re-established $50,000 as a support, but the optimism of professional traders is nowhere near the levels seen before the 26% drop to $43,000 on Feb. 28. The current scenario is far from bearish, but derivatives indicators do not reflect the substantial purchases from institutional clients, including Microstrategy, Meitu, and most recently, Aker ASA, a Norweigian oil conglomerate.Bitcoin price, USD. Source:....

Related News

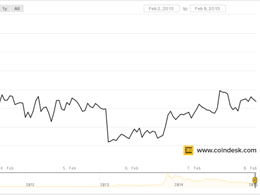

The bitcoin price stayed relatively flat over the last week, trading around the $225 mark. The digital currency opened on 2nd February at $226.40 and closed seven days later at $222.87, showing a loss of 1.56% over the period, according to the CoinDesk Bitcoin Price Index. Price movement appeared to be muted in the absence of major announcements or events. The first days of the week showed the most action. On 2nd February, the price climbed $16 to hit a high of $242. This was followed by the week's biggest intra-day swing the following day, when the price plunged $22 from a high of....

It seems the low funding rate on ETH futures contracts and the recent 96% rally are not enough to convince traders to buy the Ethereum price dip. Cryptocurrency price corrected sharply today, including Ether (ETH), but this is a short-term move which is not reflective of the more macro-level events which still paint a bullish picture for assets like Ether and Bitcoin. In the last 30 days, Ether price gained 96%, moving from $2,138 to $4,200 on May 11. Normally the assumption would be that every trader is consumed with euphoria and this would be seen in the funding rate reaching record....

Bitcoin reclaims support at $44,000, prompting some analysts to suggest closing out longs while looking for a close above $45,000 to signal a bullish trend reversal. The mood across the cryptocurrency ecosystem has shifted to cautious optimism on Feb. 7, as Bitcoin (BTC) bulls managed to bid its price back above support at $44,000 with the help of several positive developments, including the announcement that “Big Four” auditor KPMG has added BTC and Ether (ETH) to its corporate treasury. Data from Cointelegraph Markets Pro and TradingView shows that, after hovering around $42,500 during....

Bitcoin price may have broken above $20,000 but the 40% decrease in volume shows bears are watching BTC closely. Today Bitcoin (BTC) price blasted through the $20,000 level and in the process, a record $7.9 billion in futures open interest was set. Although the price increased by 74% over the past two months, the total accumulated short-seller liquidations amounted to $4.3 billion, which is lower than the $4.8 billion from longs.BTC futures aggregate open interest. Source: Bybt.comAs shown in the chart above, the futures aggregate open interest increased by 90% over the past two months.....

Bitcoin slid sharply over the weekend, breaking below $76,000 in thin trading and briefly dipping through the $75,000 area as selling accelerated late Saturday into Sunday. The move pushed BTC into a zone that technician Aksel Kibar has identified as a key band of horizontal support, roughly between $73.7K and $76.5K. The move didn’t come in a vacuum. Macro markets were already in a forced-risk-off posture, with a violent sell-off in precious metals feeding broader deleveraging dynamics, exactly the kind of tape that can amplify weekend volatility when liquidity thins out and stop levels....