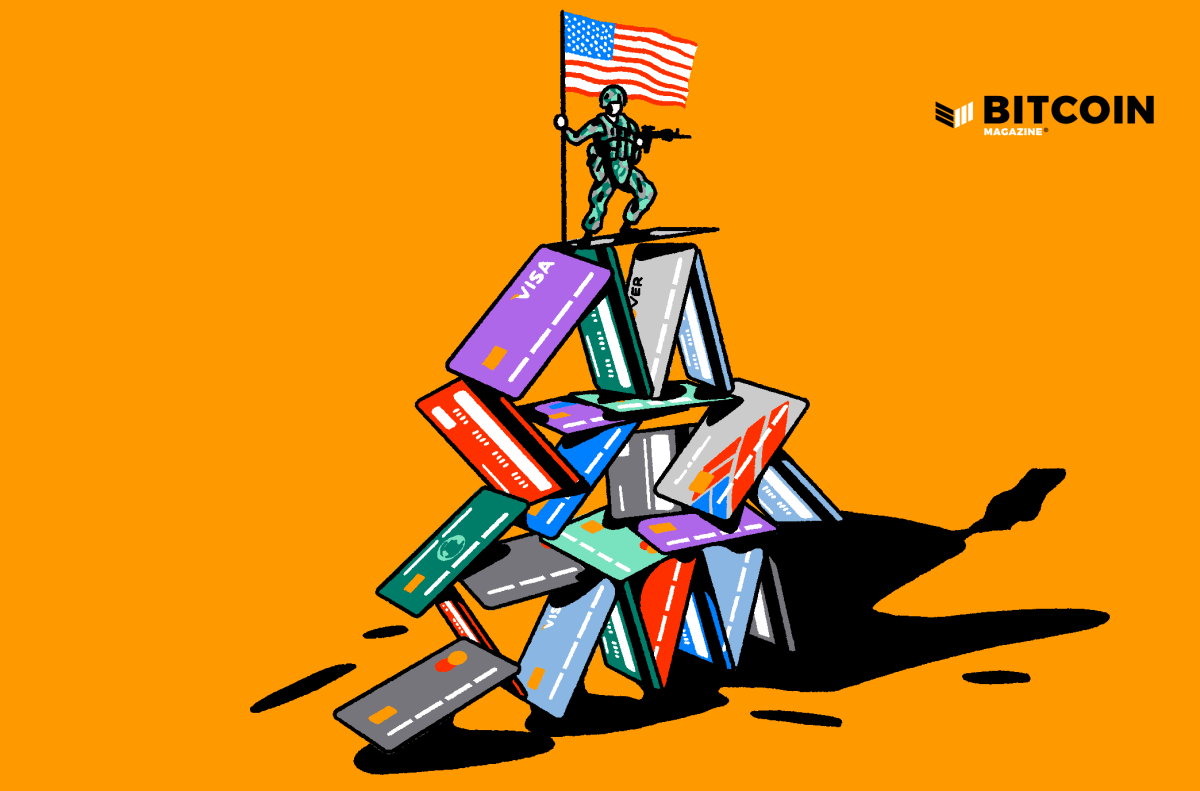

The Invisible Cost Of War In The Age Of Quantitative Easing

Through increasingly unscrupulous monetary policy, U.S. government officials mask the costs of war from the American public. Bitcoin could fix this.On February 24, 2022, Vladimir Putin ordered the Russian military to initiate a full-scale invasion of Ukraine. The Russian people, outside of a few thousand brave and quickly-punished protestors, had no way to prevent their government from going to war. It was the decision of a dictator.Because there are no structural domestic checks and balances on Putin’s power, he was able to unilaterally push forward with an invasion that seems deeply....

Related News

Quantitative Easing and Bitcoin. The European Central Bank has recently announced a 1.1 trillion Euro sovereign bond purchasing program. This action in broadly referred to as Quantitative Easing. It is a monetary policy brought into existence by the Bank of Japan on March 19th, 2001. The first concept to understand in relation to Quantitative Easing is that no expert or policy-maker truly knows how this monetary experiment ends because it is a historically unprecedented action. A 15 year existence is a negligible amount of time in the history of human commerce. With that in mind, while....

Bitcoin has not grown at the rapid rate expected so far in the cycle, and some have blamed this on the fact that the Federal Reserve has been practicing quantitative tightening. This refers to a period when the central bank is reducing its money supply in a bid to reel in excess liquidity. As a result, buying power seems to have fallen as there isn’t enough liquidity flowing into risk assets such as Bitcoin. However, this could all be changing very soon as the Fed begins to change its stance. Quantitative Easing Could Bring About More Liquidity After a long stretch of quantitative....

Unlike the central banks’ quantitative easing policy, the reduction of new funds being pumped into the Bitcoin ecosystem is stabilizing the price. It is not the first time some experts are pointing towards Bitcoin as an asset to keep an eye on whenever financial trouble seems to be looming on the horizon. Cryptocurrency is a once-in-a-lifetime investment opportunity, due its scarcity and global availability. Even though some people may argue it is too late to invest in Bitcoin or other currencies, that is far from the case. Moreover, the policies employed by banks to solve the economic....

What to Know: 1️⃣ The Federal Reserve’s return to quantitative easing could unleash a wave of global liquidity — potentially driving Bitcoin and altcoins toward 100x returns as investors chase risk assets. 2️⃣ Bitcoin Hyper ($HYPER) stands out as a strategic altcoin play, built as a Layer-2 scaling solution designed to extend Bitcoin’s speed, utility, […]

Since well before the onset of Covid-19, the U.S. Federal Reserve had initiated monetary easing policies and from then on, the M1 Money Stock supply skyrocketed to levels never-before-seen in history. This weekend reports disclosed that the Fed has started to taper quantitative easing (QE) when it removed $351 billion from the market last week. This Tuesday the Fed revealed it completed a reverse repo operation for $432.9 billion. On May 22, Bitcoin.com News reported on the Federal Reserve initiating overnight reverse repos (RRP) to the tune of $351 billion. Tuesday’s recently....