Bitcoin Short Squeeze Flushes Out Late Longers as Funding Turns Negative: Cla...

Bitcoin is struggling to reclaim the $90,000 level as selling pressure continues to dominate across the crypto market. The sharp decline from the all-time high has fueled growing speculation that the current cycle may have already peaked, with many analysts now calling for the beginning of a bear market. Sentiment has shifted rapidly, and fear is spreading as traders question whether the bullish structure has been permanently broken. Related Reading: Bitmine Scoops Up Another 28,625 Ethereum ($82.1M) as Market Bleeds – Details However, not everyone agrees with the bearish outlook. A....

Related News

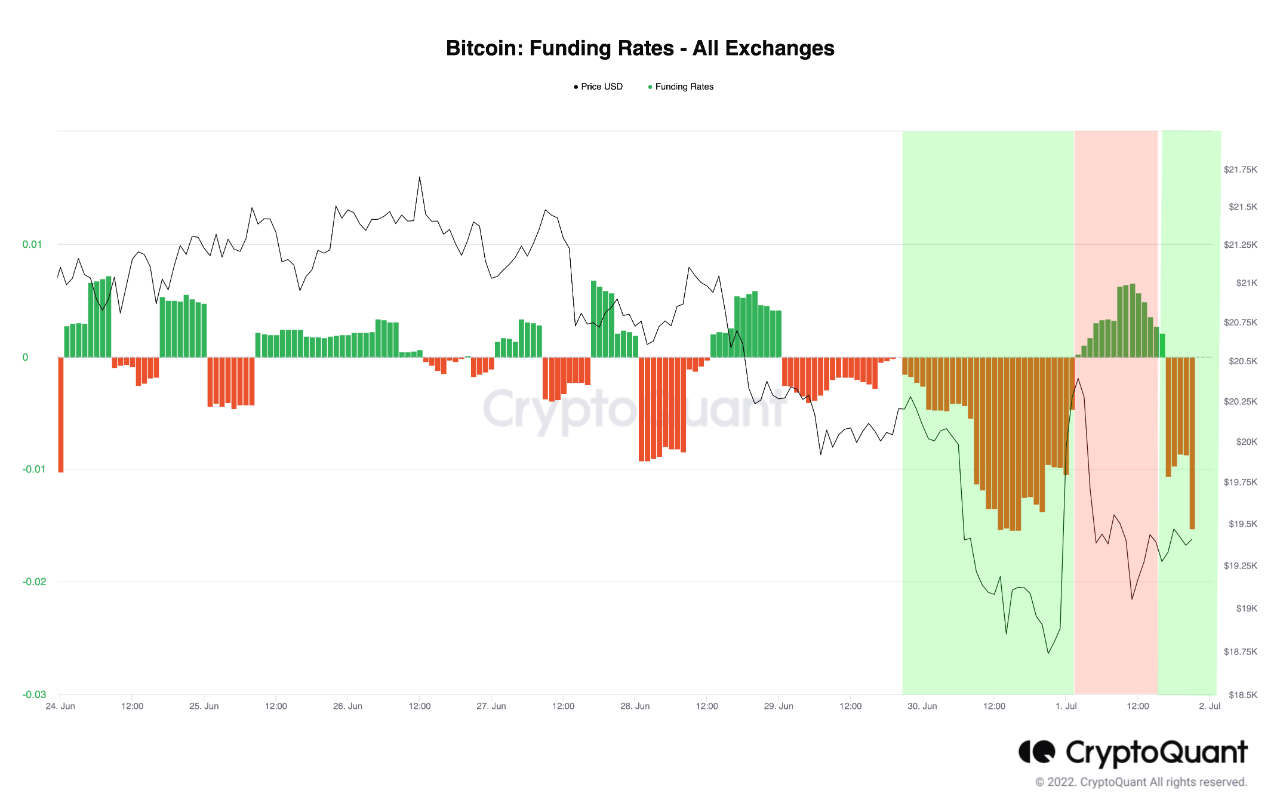

On-chain data shows Bitcoin funding rates have sunk into deep negative values, something that could pave way for a short squeeze in the market. Bitcoin All Exchanges Funding Rate Has A Red Value Right Now As pointed out by an analyst in a CryptoQuant post, BTC may see a slight uplift in the short term […]

Bitcoin has struggled below the $90,000 level since last week and is now attempting to stabilize as selling pressure continues to shape market sentiment. The sharp downturn from the recent cycle high has left bullish traders on the defensive, with confidence weakening across spot and derivatives markets. Analysts who just weeks ago projected continuation toward new all-time highs are now shifting their tone, with many calling for the beginning of a bear market. Related Reading: Bitcoin Short Squeeze Flushes Out Late Longers as Funding Turns Negative: Classic Capitulation Signal The broader....

Data shows the Ethereum Funding Rate has declined into the negative zone. Here’s what has usually followed this trend in the last two months. Ethereum Funding Rate Suggests Traders Are Now Bearish As explained by analytics firm Santiment in a new post on X, shorts are dominating the Ethereum derivatives market now. The indicator of […]

Ethereum continues to trade below the critical $3,000 level as selling pressure intensifies and fear dominates sentiment across the crypto market. The broader downturn has pushed ETH nearly 40% below its August all-time high, raising concerns that the asset may be entering a prolonged bearish phase. Analysts who were once confident in a continued rally are now shifting their tone, warning that market structure, volatility, and liquidity conditions are beginning to resemble early-stage bear market behavior. Related Reading: Bitcoin Short Squeeze Flushes Out Late Longers as Funding Turns....

Bitcoin price saw a sudden 2.5% drop after hitting as high as $19,570 in an overnight rally. The Bitcoin price (BTC) surged above $19,500 briefly on Dec. 15, reaching as high as$19,570 on Binance. However, BTC then dropped to $19,050 within three hours, recording a sudden 2.5% pullback.Bitcoin spiked to around $19,600 because of the momentum of its relief rally and negative futures market funding rates. But, it rejected the same level it broke down from since November due to the selling pressure from whales.Bitcoin 1-hour price chart (Coinbase). Source: TradingView.comA relief rally for....